![]() Call Now: (213) 536-7242

Call Now: (213) 536-7242

Monday - Friday: ![]() 9.00am to 5.00pm

9.00am to 5.00pm

Active Shooter Insurance

Protecting Your Peace of Mind: Active Shooter Insurance by Laurence Taylor Insurance Services

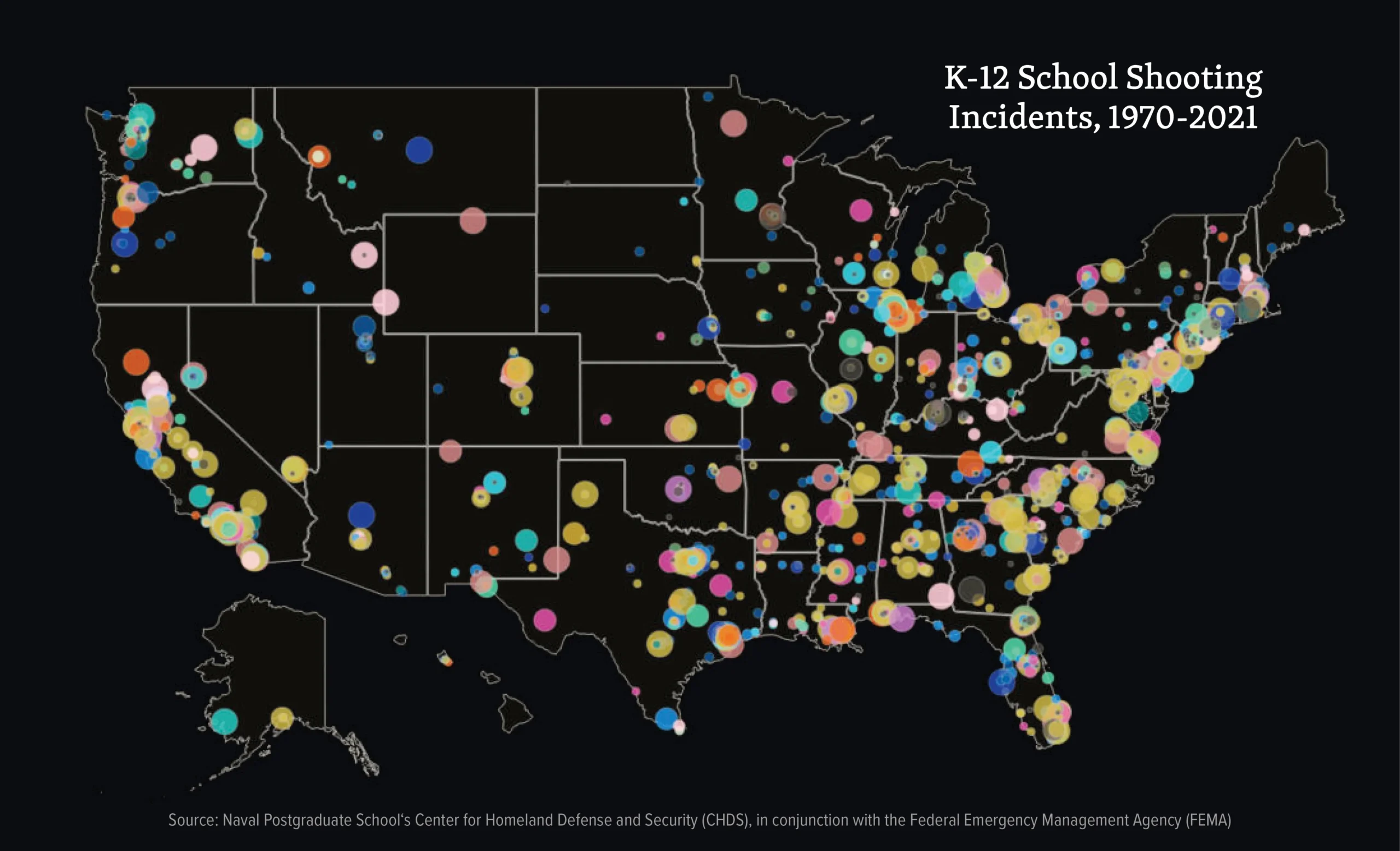

Active shooter insurance is a type of coverage that can help protect businesses in the event of a violent attack by an individual or individuals on their premises. This type of insurance can provide financial assistance for things like medical expenses, funeral costs, and property damage that may occur as a result of an active shooter situation. While we hope that such incidents never happen, having this type of insurance can give business owners some peace of mind knowing that they have some support in place in case the worst happens. It’s always better to be prepared for the unexpected and have some level of protection in place. According to a report by Gun Violence Archive, the non-profit research group that defines these acts of violence as any event involving the shooting of four or more people other than the assailant, the United States witnessed 200 mass shootings in the first 132 days of 2021.

Active shooter insurance provides coverage for potential incidents of violence in public spaces such as schools, churches, universities, restaurants, businesses, and other establishments in Los Angeles, California. This type of insurance can help cover the costs associated with medical expenses, property damage, legal fees, and counseling services in the event of an active shooter situation. It is unfortunate that we live in a world where these types of incidents occur, but having active shooter insurance can give peace of mind and protection in case the unthinkable happens. It is important for businesses and organizations to consider investing in this type of insurance to protect themselves and their patrons from the potential risks of violence.

Now is the time to get insured against Gun Violence and Mass shootings

Department of Homeland Security (DHS) categorizes Active shooter event as being perpetrated by individuals “actively engaged in killing or attempting to kill people in a confined and populated area.” These shooting events have taken place in a variety of places like Schools, Churches, bars, pubs and various other public settings. All over the US these events have caused much loss of life and damage of public property.

Due to the increase in active shooter incidents, the demand for Active shooter insurances have seen a significant rise over the years. According to Tarique Nageer, terrorism placement advisory leader at Marsh,inquiries for active shooter policies have risen 50 percent year on year in within a short period of time. Seeing the surge in demand, commercial insurers and industry experts have created a unique coverage and insurance plans that can assist organizations in minimizing the damage from the active shooter incidents. Offering a blend of property and damage insurances, gun violence and assailant inclusion can supplement the overall risk and property damage coverage that most organizations as of now buy, providing one more layer of assurance against the danger from perpetrators of gun violence and mass shootings.

Active Shooter Insurances have acquired much demand in recent years following a spate of acts of gun violence and mass shootings. These insurances commonly cover casualty claims, damage repairs, legal charges, medical costs and counseling for trauma and PTSD.

Why Laurence Taylor Active Shooter Insurance is the one to go with?

Laurence Taylor Active Shooter Insurance offers complete coverage to the victim and survivors of an Active Shooter incident with minimum or no exclusions. Laurence Taylor Active Shooter Insurance has a no terrorism exclusions, no vehicles exclusions, no casualties’ threshold, no drone exclusions policy which insures the insure of complete coverage. There are sections, especially important public places such as Schools and Universities, Restaurants and Hotels, Houses of Worship, Manufacturing Plants, etc. that should have an Active Shooter Insurance. No matter what class you fall into, there is some information that you need to provide to Laurence Taylor Active Shooter Insurance to ensure maximum coverage. This information makes the claim easier to track for us and to offer a better coverage.

Laurence Taylor Active Shooter Insurance is the best choice for ensuring protection in the event of an active shooter situation. Their policies are comprehensive and tailored to fit your specific needs, giving you peace of mind knowing that you are covered in a worst-case scenario. With their team of experienced professionals, you can trust that you are in good hands every step of the way. Don’t risk being unprepared – choose Laurence Taylor Active Shooter Insurance for the security and support you need in uncertain times.